Optimizing banking and financial services with AI-powered automation

In the fast-paced world of banking and financial services, innovation is the key to staying ahead. To meet the demands of customers and drive operational excellence, organizations are embracing the combined power of artificial intelligence (AI) and automation. From transforming document processing to revolutionizing customer communication, these cutting-edge technologies are reshaping the industry.

In the recent UiPath AI Summit, Shameiz Hemani, CEO at Greenlight Consulting, joined Bill Hincher, Director of Financial Services at UiPath, and Nitin Purwar, Senior Banking and Financial Services Industry Practice Director at UiPath in an insightful discussion on the transformative influences of AI-powered automation on banks and financial services firms.

For a limited time, access all UiPath AI Summit session recordings.

Document processing to boost efficiency and accuracy

The banking and financial services industry deals with a vast array of documents, ranging from structured to semi-structured and unstructured formats. This document-heavy environment often results in time-consuming and error-prone manual processing. However, AI is changing the game.

AI-powered Document Understanding machine learning (ML) models in the banking and financial services sector are being deployed to extract data from documents such as passports, identity proof documents, and mortgages. Organizations can train their own models to cater to the specific document types they handle. By automating the extraction process, the time taken to handle these documents can be significantly reduced, leading to exponential gains in efficiency.

Unstructured communication handling to enhance customer service

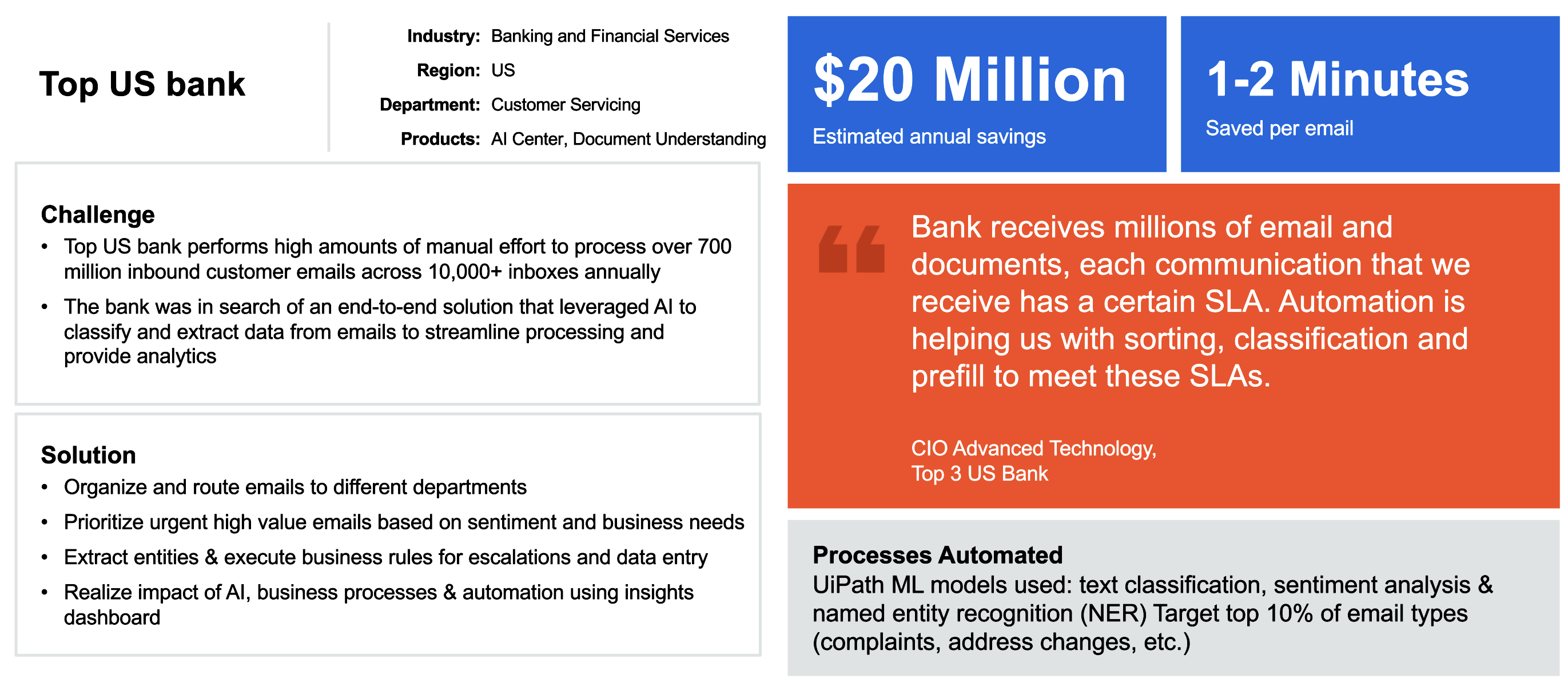

The rise of email, virtual chat, and SMS as communication channels has brought forth a new challenge for financial institutions—handling unstructured customer communications effectively. AI-powered automation is being leveraged to address this challenge by analyzing and understanding incoming requests, complaints, and disputes from customers.

ML models interpret these unstructured communications, extract relevant information, and take necessary actions. This automation dramatically reduces response times, leading to improved customer satisfaction. Furthermore, UiPath AI Summit speakers highlighted the importance of understanding customer sentiment in incoming requests and queries.

They shared a specific example of a consumer bank. The models they used performed two levels of classification, categorizing emails and understanding their intent. Banks could gain insights into customer perception and identify areas of frustration or challenges with certain products. This approach was implemented for the bank across three product categories: cards, liabilities, and loans. Additionally, relevant field data were extracted using a combination of automation and ML models. This enabled the creation of an auto-response framework, with approximately 30% of emails receiving contextual responses. The results were impressive, with nearly 95% accuracy in multi-level classification and a drastic reduction in response time.

By leveraging ML models and investing in Communications Mining capabilities, banks can enhance customer experience and achieve significant returns on investment. The speakers acknowledged the growing interest in AI-related topics and customer experience within the industry.

Source: UiPath

Combining automation and next-generation capabilities

The integration of automation with next-generation capabilities like ChatGPT is opening new possibilities for the industry. By combining these technologies, organizations can broaden the scope of use cases and deliver even more personalized and impactful solutions.

Recommended reading: Leveraging ChatGPT in Automation Development and Design

One example is the use of automation and ChatGPT in wealth management. Automation collects relevant data while ChatGPT generates tailored content, resulting in visually appealing presentations that can be used by wealth advisors to provide personalized advice to clients.

The OpenAI connector enables organizations to leverage the power of automation and AI simultaneously, enhancing customer experiences. It does so by merging the strengths of UiPath AI-powered automations with additional AI from the external ecosystem, creating a seamless blend of cutting-edge technology and operational efficiency.

What's next?

As we look to the future, it’s clear that AI-powered automation will continue to shape the banking and financial services industry, enabling financial institutions to stay competitive, adapt to evolving customer needs, and deliver exceptional services. Embracing these technologies will be crucial for organizations aiming to thrive in the ever-changing landscape of banking and financial services.

Don’t miss out on the complete recording of the AI Summit 2023. Watch the on-demand videos now.

Product Marketing Manager, UiPath

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.