How Recession Winners Will Use RPA and Process Mining to Emerge Stronger

As business opens back up after the 2019 novel coronavirus (COVID-19) peak passes and we enter what is predicted to be a global recession, history has taught us that some companies will emerge even stronger. These companies will be able to adjust to the ongoing profit and revenue impacts because they invested in technology that drives greater productivity and operational efficiency.

According to the Gartner Predicts 2020: RPA Renaissance Driven by Morphing Offerings and Zeal for Operational Excellence report*, “by 2024, organizations will lower operational costs by 30% by combining hyperautomation technologies with redesigned operational processes.”

"Hyperautomation builds on the real success that underlies the phenomenal growth of Robotic Process Automation (RPA): ease of automation, speed to outcomes, and a now proven path to applying artificial intelligence (AI) to improve business operations," explains Bobby Patrick, chief marketing officer (CMO) at UiPath.

Hyperautomation is not a separate automation technology. The term references combining RPA, AI, and other automation technologies as we do in the UiPath end-to-end automation platform.

However, one might argue that hyperautomation investments are a luxury that cannot be afforded as today’s harsh reality is many companies are slashing pay, furloughing workers, and taking drastic measures to reduce costs.

What should one do?

Do you invest in the digital advantage that is proven to arise from hyperautomation or cut costs across the board and freeze investments to weather the storm?

To resolve this dichotomy, we can look to data from our last recession to determine which companies emerged stronger from the recession and were able to achieve breakaway performance compared to their competitors.

Harvard Business Review (HBR) analyzed financial data from 4,700 public companies in a comprehensive study of the Great Recession of 2008 and found that companies like Staples were able to contain operating costs and came out of the recession bigger and more profitable. In fact, Staples doubled revenue from 1997 to 2003 and was about 30% more profitable than its arch rival Office Depot in the three years after that recession.

The HBR research shows that there was a group that separated from the pack after the recession doing better than their industry rivals by at least 10% in terms of sales and profits growth.

Who were the recession winners?

“A subset that deploys a specific combination of defensive and offensive moves has the highest probability—37%—of breaking away from the pack. These companies reduce costs selectively by focusing more on operational efficiency than their rivals do, even as they invest relatively comprehensively in the future by spending on marketing, R&D [research and development], and new assets…Most enterprises implement aggressive cost-reduction plans to survive a recession. But companies that attend to improving operational efficiency fare better than those that focus on reducing the number of employees.”

How do we improve operational efficiency?

Operational efficiency is generally regarded as well-managed time, resources, and funds. We often inspect the productivity of the overall organization to judge the ability to improve profit. This same lens can be used to view individual processes, such as order to cash, from the bottom up to improve operational margin or profit by performing the processes cheaper, better, or faster. To measure the profit generated from improving operations, we must understand how well the organization is turning inputs to outputs in three high-level strategies:

Cheaper - Same for less, i.e. same output for less input (by reducing operational expenditures, capital expenditures, etc.)

Better - More for same, i.e. achieve more output (or more compliant, error-free processes) for the same input

Faster - Much more for more, i.e. achieve much more output in less time even if it requires more input (by spending selectively on technology, marketing, etc.)

Back in 2008, these were alternatives that strategist had evaluated as tradeoffs. Today, organizations are leveraging hyperautomation to break those old rules and are deploying a mix of all three strategies to drive multiple outputs. Now, traditional financial and operational outputs like revenue, number of defects, and customer count are expected to drive value as well for softer measures such as customer experience and more empowered employees. Employees have always been a company’s ‘greatest asset,’ representing both the major cost and the major driver of value, so investments in employee productivity have a major impact on financial metrics.

A recent customer example underscored this point. The chief financial officer (CFO) of a high tech, manufacturing company stood up in front of the room to kickoff off a new RPA initiative for the company and declared, “this is not about the robots, it is about the people. This is an upskilling investment in employees and my hope is that it will ultimately benefit our customer experience as well.”

The CFO went on to explain that they have too many people and too high of costs associated with fulfilling small orders. By streamlining the small order processes and shifting that work to software robots their people will be able to focus on giving a better experience to the most important customers.

Hyperautomation technologies, such RPA, task mining, and process mining, are tools that were not available to leaders during the last recession. Recession winners this time around will use this technology to make bold decisions about where to selectively reduce costs—using the same for less strategy—but also choose where to go on offense with the much more for more strategy.

It's time to automate

Let’s imagine a scenario where the CFO of the manufacturer mentioned above has stated he is looking for ideas from employees to generate more profit. You believe you may be able to automate your invoice processing and eliminate wasteful rework that could boost employee productivity by 5% or more, but it is difficult to connect the dots between your idea and your CFO’s priorities.

You explore the idea with your robotic Center of Excellence (CoE) team. The CoE team analyzes data from your line of business systems with UiPath Process Mining to determine what should be automated.

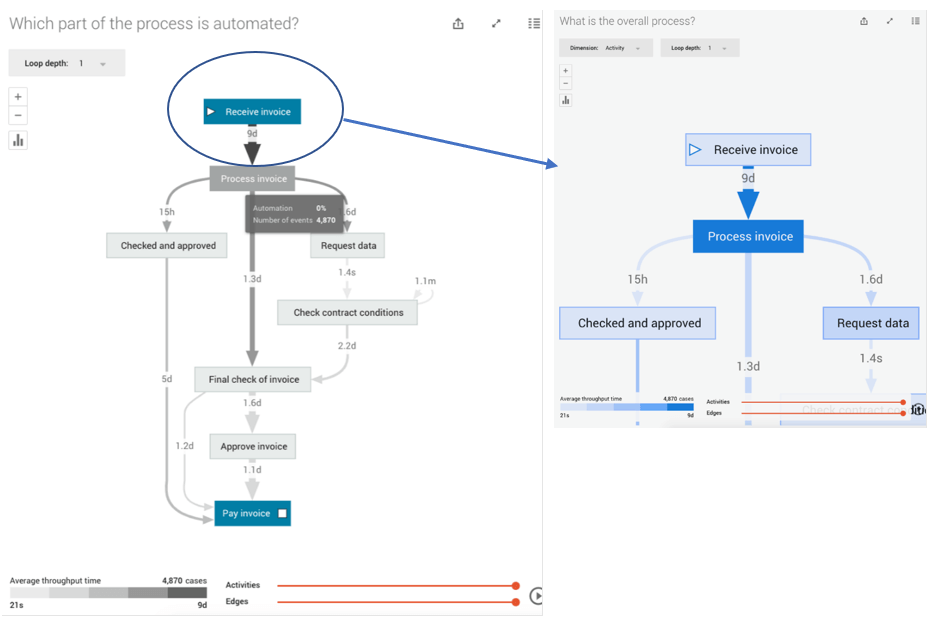

You now can visualize your invoice process for the first time. The process (as shown below) starts with Receive Invoice, then check and approve tasks, before ultimately finishing with Pay Invoice. The enlarged section of the picture shows a nine-day bottleneck on cycle time which is a drain to productivity and tells us that automation in this area could help speed up the process.

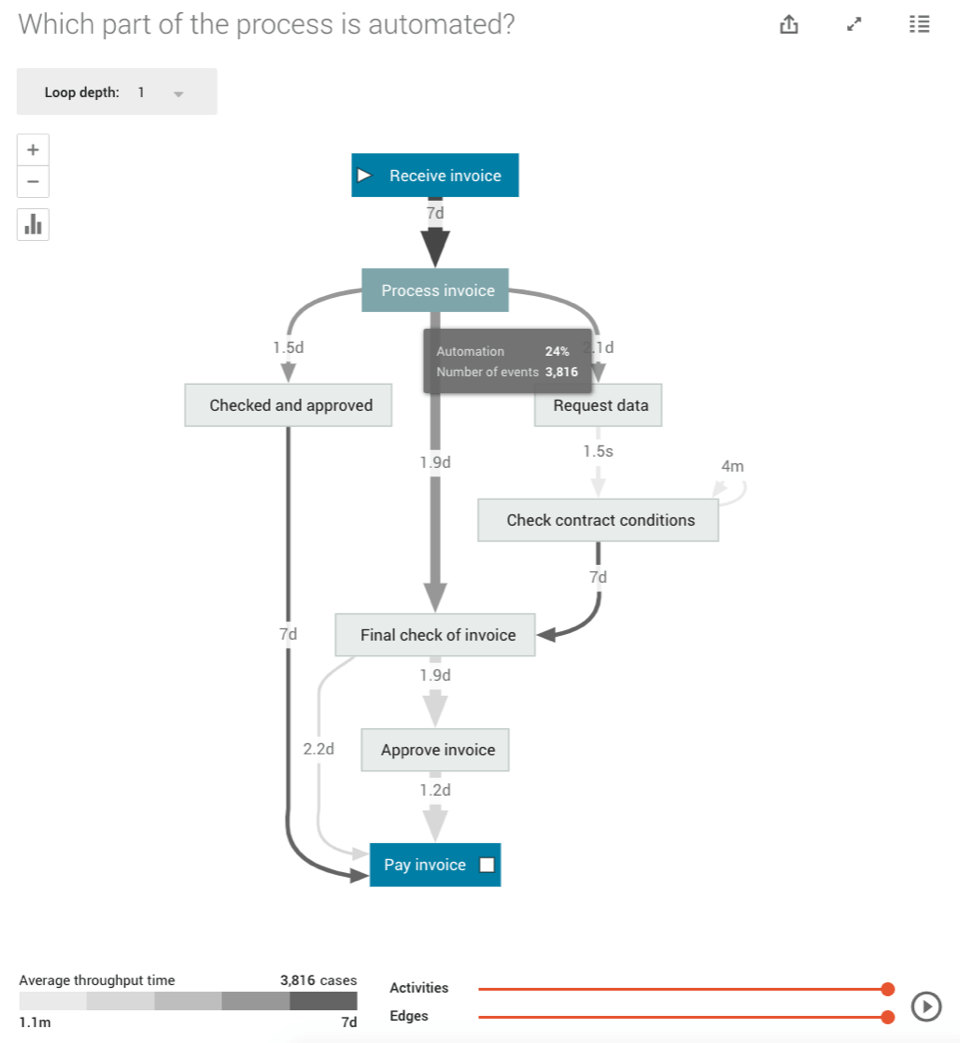

The first phase of the project utilizes UiPath robots as digital assistants to automate the request data activity, while everything in between is still manual. The picture changes (see below) after this automation pilot phase and the results are promising. We see that the Process Invoice activity is now 24% automated and the lead time has already been reduced from nine days to seven days.

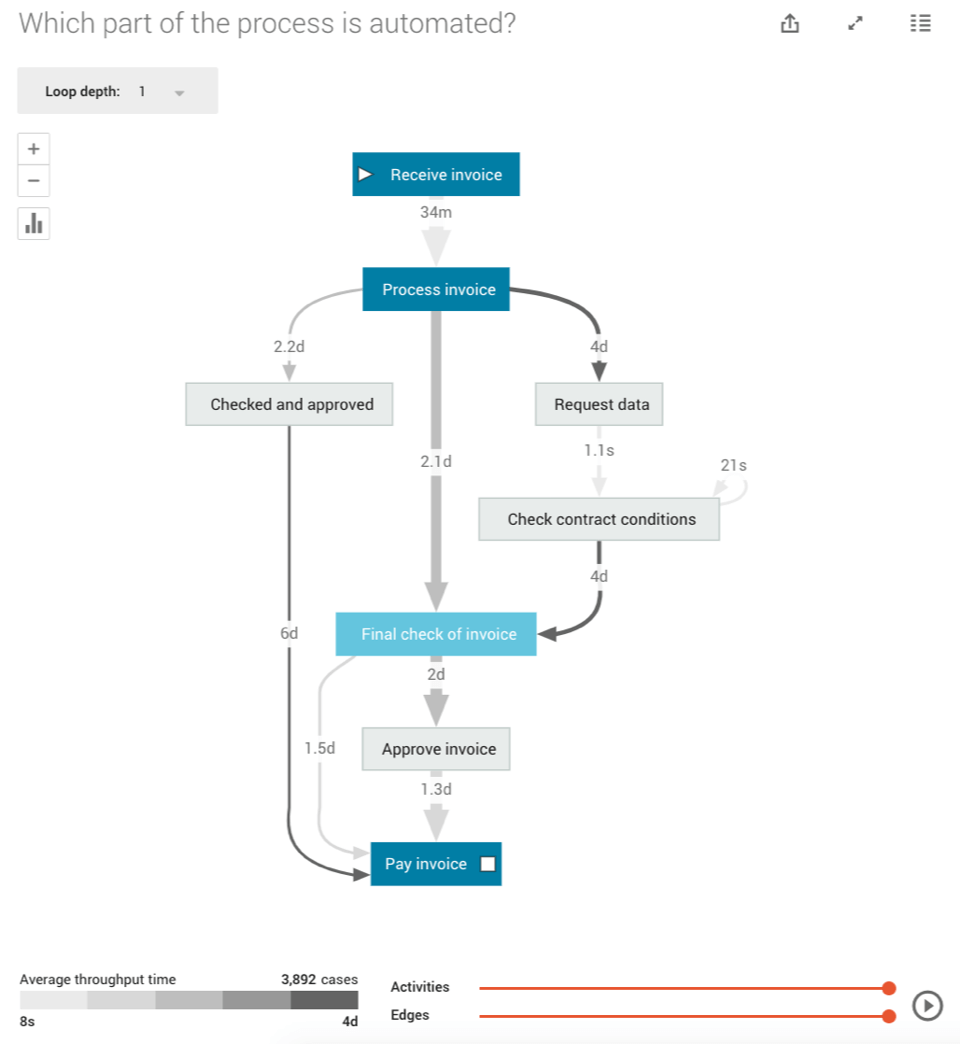

Encouraged by the early success, you decide to fully automate the Process Invoice activity and the lead time shown below has dropped to a sensational 34 minutes. It has some downstream effects as well, such as a slight increase between Final Check of Invoice and Pay Invoice, that you continue to monitor via UiPath Process Mining (see below).

This is an example of taking the ’much more for more’ operational efficiency strategy as you invest in hyperautomation to deliver a faster, error-free cycle time.

Do the math

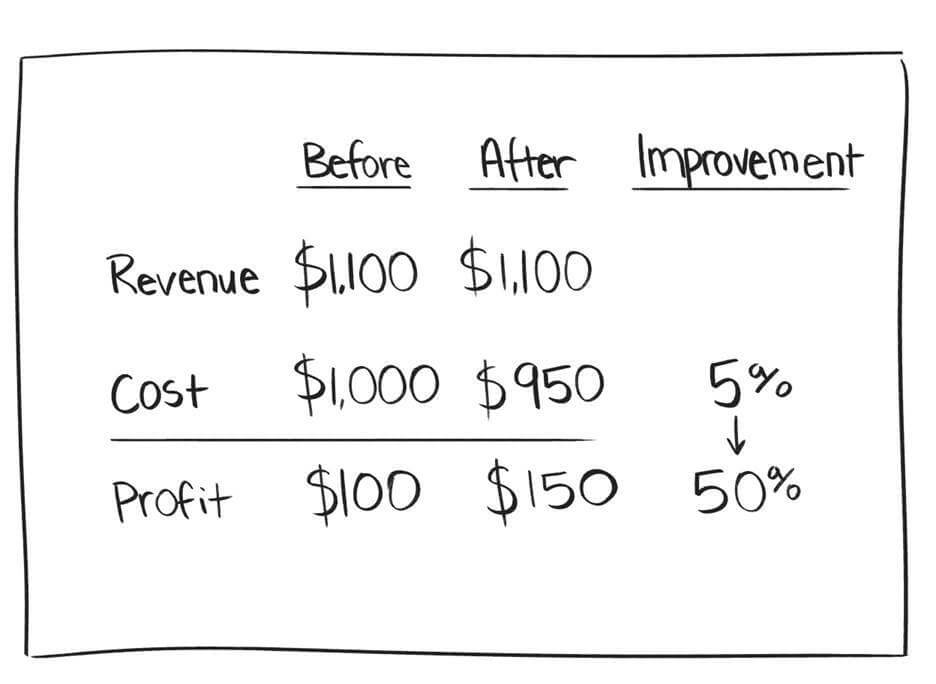

Let’s assume your business unit margins or operating profits are 10% of employee costs. This creates a 1:10 leverage point for improvements on employee productivity to operating profit that can generate cash for your CFO.

You do some quick math (see table) and your CFO is excited by the financial leverage that a 5% improvement in employee productivity increases operating profit by 50% in your business unit. Naturally, the CFO excitedly encourages you to press forward on your automation journey to automate the follow-up activity Final Check of Invoice next.

It’s time to automate!

This time around, winners will emerge from the recession stronger than every by using RPA and process mining together.

To learn more about UiPath Enterprise RPA Platform and UiPath Process Mining watch our on-demand webinar or contact our sales team.

*Gartner Predicts 2020: RPA Renaissance Driven by Morphing Offerings and Zeal for Operational Excellence, Stephanie Stoudt-Hansen, Frances Karamouzis, Arthur Villa, Saikat Ray, Rob Dunie, Nicole Sturgill, Laurie Shotton, Derek Miers, Fabrizio Biscotti , 10 December 2019

SVP, Customer Strategy, UiPath

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.