Automating Auto Loans to Drive Bigger Profits

We now live in the age of customer self-service. Consumers prefer to do things for themselves, whether it’s ordering from an online catalog or completing loan paperwork. Just look at the boom in online loan providers. Anyone can complete an online application for a new credit card or personal loan and be qualified immediately. But due to the complexities of approving auto loan applications, auto financing firms are still catching up. It’s time to automate auto loan processing with the help of robotic process automation (RPA), artificial intelligence (AI), and machine learning (ML).

Car sales are booming thanks to the repressed market created by the COVID pandemic. Consumers have been saving on transportation during the lockdown, and as coronavirus restrictions are lifted, we are seeing a spike in new and used car sales. And consumers expect a frictionless buying experience. For example, CarMax sells 8% of its vehicles online. And Carvana and Tesla sell cars online and deliver directly to consumers.

Unfortunately, the car financing experience is anything but frictionless. Auto lending is still a complex and manual process—for borrowers and lenders. Gathering the necessary data to make a credit decision is time consuming and disjointed. Lenders need to gather third-party reports, credit history, Department of Motor Vehicles (DMV) records, insurance forms, and other information.

Most auto loan documents take up 35 pages or more, and data intake is an ongoing problem, especially with a shortage of personnel to handle loan processing.

Automating the loan application process

Automating auto loan processing can cut loan approval times from weeks to days—even hours. It also improves data accuracy and enables an increase in loan volume without adding personnel. The goal is to evolve from manual processes to AI-powered robot assistants that make loan processing faster and more efficient. Companies typically progress through four stages on their way to AI-powered auto loans processing:

Manual data entry. Paper processing or “swivel-chair processing” is the most common approach to loan processing and requires someone to manually look up application data and enter it into the system.

Automated data extraction. This is the first phase of robot-powered “lightweight automation” where document processing handles data entry. Optical character recognition (OCR) technology extracts data from paper and static forms and then populates loan form fields for manual reconciliation. The system also can start using ML to apply document understanding, differentiating between data sources such as a driver’s license, pay stub, tax form, etc. Data extraction is the next big leap in loan processing automation with big benefits in both time savings and improved accuracy.

Automated intelligent matching. AI can train the system to match the information in data fields to specific criteria (such as income or credit score) as part of rudimentary decision making. Entries that fall outside preset parameters are flagged for manual review.

AI intelligent processing. AI trains the loan processing system to handle more sophisticated functions such as risk scoring and fraud detection. It also can support business analytics to predict things such as loan volume and funding requirements.

At each stage, you apply more automation to extract more efficiency, more accuracy, and more value. The entire value chain benefits, from the lender to the auto dealer, and the process delivers higher customer satisfaction.

AI and ML at work for auto loans

Automating auto loans requires a document understanding framework that can accept data from various sources and classify it for loan processing. The AI-driven framework includes five basic components:

Define document types you will be using to gather data and match them to the data fields necessary for processing auto loans.

Digitize the paperwork using OCR to ensure that the necessary loan documentation is converted to a machine-readable format.

Classify the data elements you will need to process the loan. There will be specific sections dealing with proof of income, proof of address, insurance information, details about the vehicle being purchased, etc. Each element needs to be properly classified before loan processing.

Extract the data based on the document type. Standardized forms often have a common layout with checkboxes, signature lines, etc. The AI framework takes the classified data and uses it to populate the loan forms.

Once loan forms are complete, export the data to make it available to the loan origination system. The data can be integrated directly into the loan processing system or it can be extracted as a Microsoft Excel spreadsheet or in another format for ingestion in another system.

Once the loan data is entered into the framework, you can reuse it for other paperwork and processes, such as an extended warranty, auto registration, or insurance.

UiPath also uses ML to assess classification and extraction data and generate confidence scores. The confidence score shows the degree of confidence that the data is accurate on a scale of 1 to 100. For example, data such as a Social Security number or birth date are presented in a specific way. If the confidence score falls below a preset threshold, it is flagged for human review. With every review, the system gets smarter and bot performance improves over time and the confidence score improves.

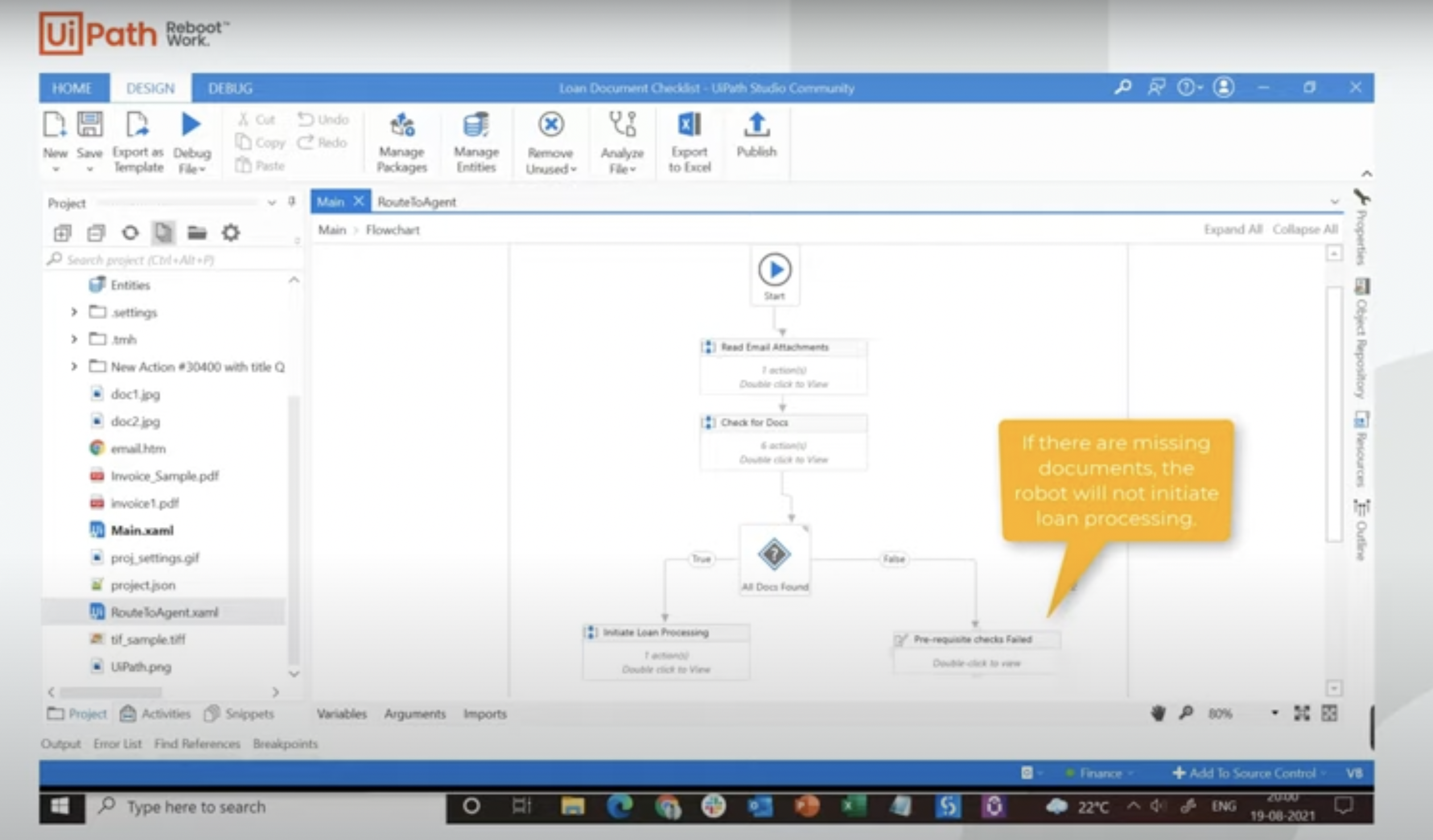

The video above shows an example of how robots can aid in a general loan processing workflow via UiPath Action Center.

Generating sustainable ROI

For lenders underwriting auto loans, the return on investment (ROI) from automating auto loan processing is impressive. Manual loan processing demands a lot of time inputting and evaluating data:

30% of the time on document classification

25% of the time on data extraction

25% of the time on data validation

20% of the time on decision making

When you use automation to ingest data and manage the document process, you spend significantly less time on those same tasks:

10% of the time on document classification

15% of the time on data extraction

10% of the time on data validation

10% of the time on decision making

The result is as much as a 55% total reduction in loan processing time.

Editor's note: the data provided are from customer conversations and based on data provided by UiPath customers.

So, with RPA, more than half of the time previously spent on manual loan processing is now available to handle more loans or engage in deeper conversations with the dealer network and customers.

Investing in automation for auto loan processing yields sustainable returns. Not only is it easier and less expensive to process each loan, but there are other savings. Rather than hiring more staff to handle the increase in loan volume, automation frees time so a smaller team can process more loans. It also means processing loans faster for customers. That means more satisfied customers who didn’t go elsewhere for their auto loan, more loans processed, and a bigger market share.

Using RPA reduces the time required to approve a loan by 30% to 50%. That means lenders can close 20% to 30% more loans. It also means that consumers get to drive their new cars off the lot sooner.

To find out how automation can help with your automotive lending practices, watch our "Accelerating Auto Lending Through Automation" webinar. The on-demand webinar is available for you to watch at your convenience.

This post was co-authored by Amit Kumar. Kumar is Vice President of Industry Practice, BFSI, at UiPath.

Director of Artificial Intelligence Product Marketing, UiPath

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.