Banking on change: How process mining can help banks evolve

Banks have always been operations- and process-heavy. They deal with high volumes of customer queries, long processing times, strict compliance, and steep regulatory penalties. Because productivity varies from agent to agent and branch to branch, banks can struggle to have a uniform level of operations. This variance often puts pressure on the customer experience, in a world where customers expect more streamlined digital experiences. With people feeling increasingly frustrated by traditional banking processes, banks face a growing need to evolve and have a digital-first mindset.

One way banks can achieve this goal is by automating existing workflows to become more operationally efficient.

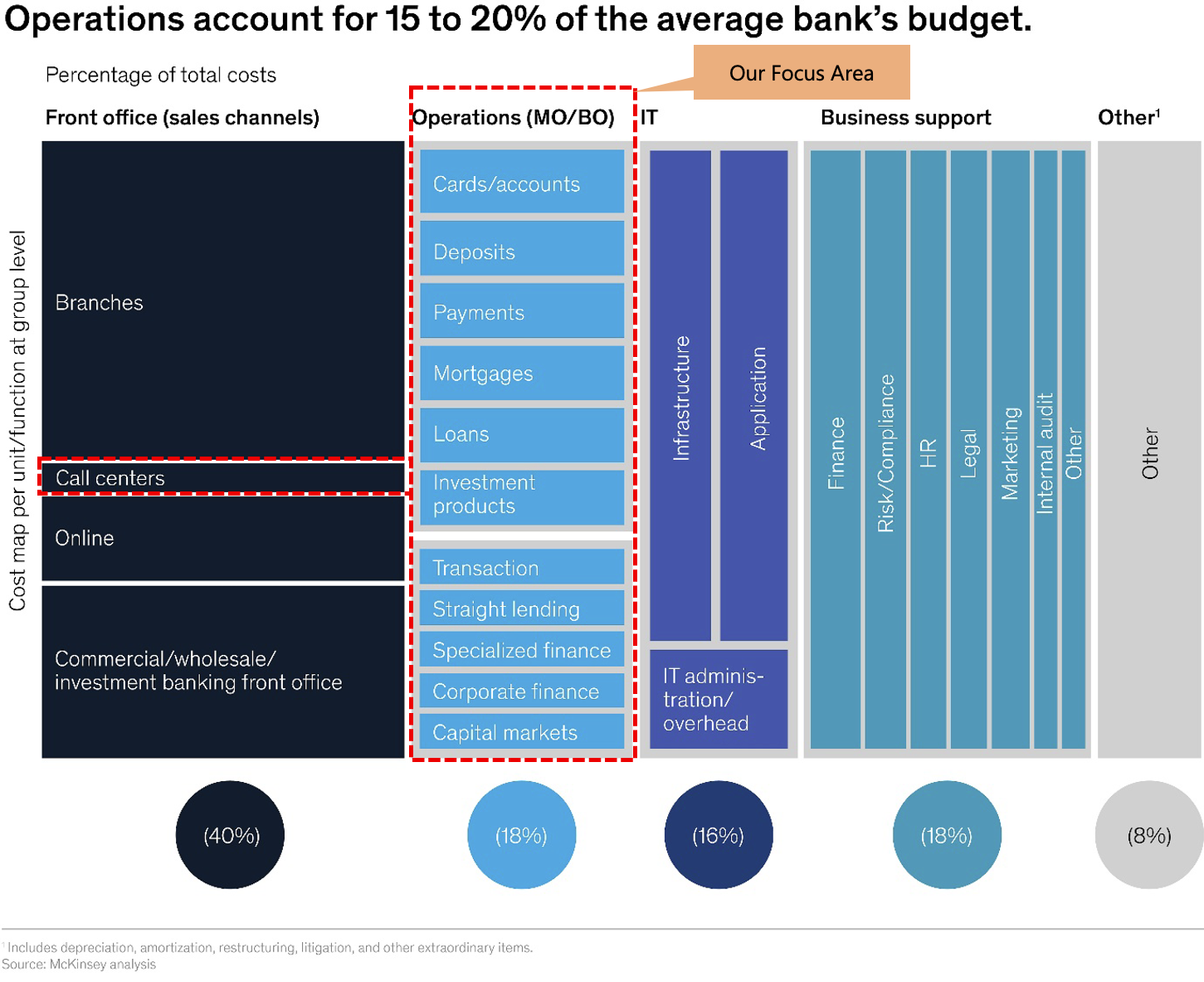

A report by McKinsey cites that “operations account for 15-20% of the average bank’s budget,” and that “75 to 80 percent of transactional operations can be automated.” Banks today have very little visibility into end-to-end operations and process variations. Therefore, they struggle to identify the right process automation candidates to reap the dividends of their digital transformation initiatives.

Technologies like process mining can help banks gain process visibility and evolve their processes with automation.

Source: McKinsey

Process mining: the key to making sense of business data

Process mining is about order—order from the chaos of digital footprints left by transactions in an organization's system of record. Think about enterprise resource planning (ERP) systems, ticketing systems, and service management systems. Process mining is a non-intrusive, fast, and data-driven method of discovering your processes, then improving them.

New to process mining? Start by reading our explainer: What is Process Mining?

Process mining requires that every analyzed transaction has the following unique identifiers: a unique ID, activity description, and timestamp. The extracted data is used to visualize a process flow and show the as-is process.

For banks, process mining can deliver much-needed process visibility. That visibility is critical before evolving processes. Banks use modern ERP suites, so there's a lot of data in their IT systems (including transactional data). Additionally, most banking operations have a unique ID running through them, such as credit card application numbers, loan application numbers, or customer IDs.

Process mining use cases every bank should know about

There are several areas that banks can start exploring with process mining.

Mortgage and loan processing

Typically, bank customers in the United States (U.S.) have to wait approximately one month for mortgage application approval. In India, even if the loan application and the corresponding documentation is in order, the process can still take at least two weeks.

Long processing times differ due to a variety of factors, such as data entry errors by customers or employees, missing documentation, delays in communication between front and back offices, or ineffective eligibility screening.

Process mining can help banks reduce customer dissatisfaction and churn by:

Understanding the throughput time of different activities and common bottlenecks (improving processing times as a result)

Diagnosing process variations via the most common variants and identifying reasons for deviations

Tracking service-level agreement (SLA) breaches, allowing for faster actions when those SLAs are breached to better meet compliance regulations

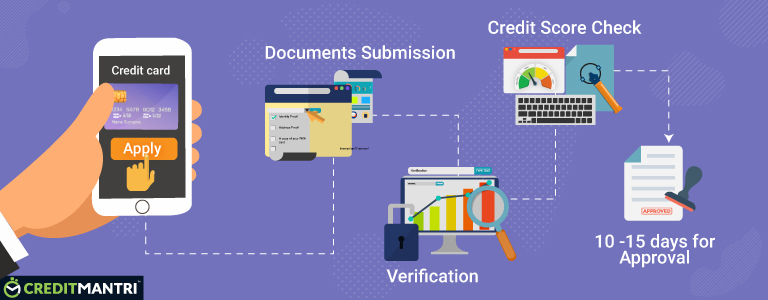

Issuing credit cards

The process of issuing a credit card starts with “verifying the authenticity of documents.” Often there's a delay due to missing or inaccurate documentation and the bank must bear the cost of rework.

Even if the bank approves the credit card and credit limit, it may need to do a document check. Any rework or delay at this stage negatively affects the turnaround time for issuing a credit card.

Source: CreditMantri

Process mining can help reduce rework and process inefficiencies when banks issue credit cards by:

Tracking the process activities that take the most time. The analysis can be drilled down to the specific cause of delay.

Reducing delays due to incorrect customer details, incomplete documentation, incorrect credit card selection, or bypassing approvals.

In credit card processing, analysis via process mining can drill down to a specific type of credit card. The analysis can be done at multiple levels (such as regional office, branch office, etc.) to find the best- and worst-performing branches. This multilevel analysis helps banks identify best practices and then implement those practices across the organization.

Customer service

Process mining can find patterns in customer service data to determine when customers get answers and how the organization’s customer service overall performance compares to industry norms related to key performance indicators (KPIs). This helps banks identify the best candidates for process improvement within each channel to enhance the customer experience.

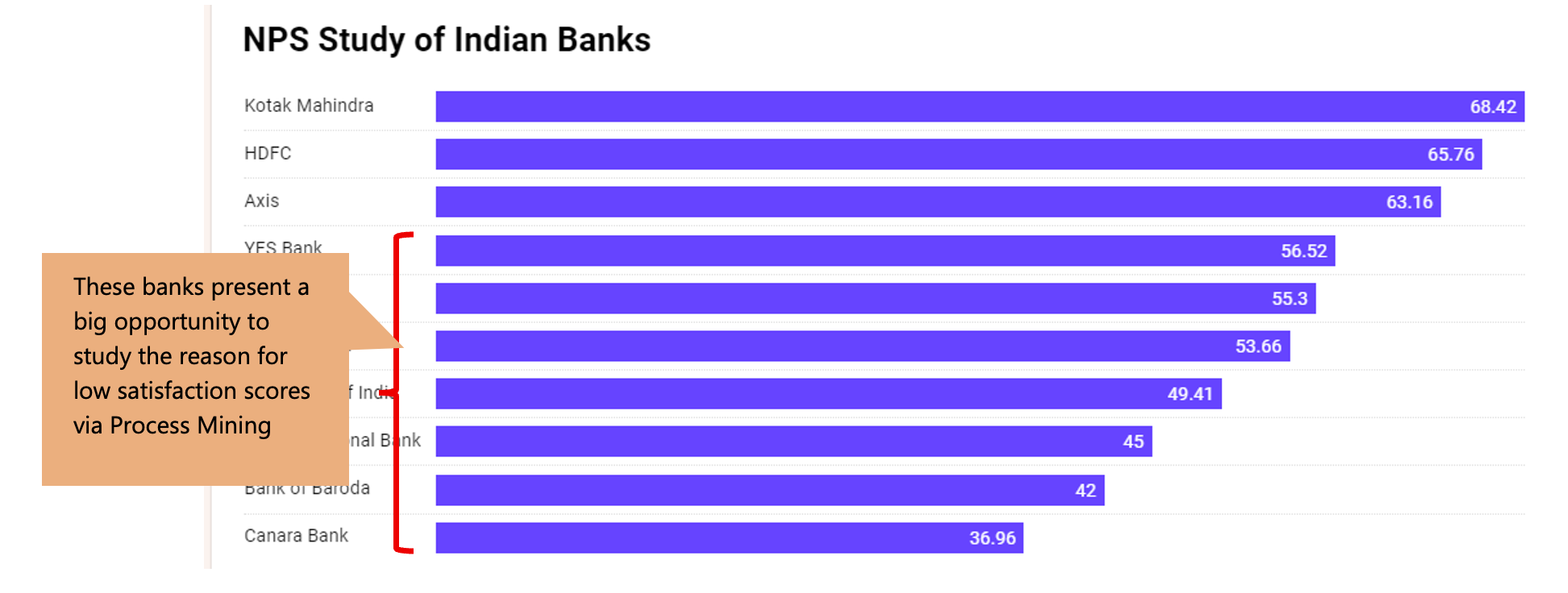

Bank customers often complain of long wait times for issue resolution. This survey found that banks have an average net promoter score (NPS)—a key metric of loyalty—of 30 points. By comparison, tech companies such as Amazon and Apple have scores in the 60s and 70s.

One of the main reasons for poor customer satisfaction scores are the frequent mergers that take place in the banking industry. In India, the merger of state-owned banks leaves a gaping hole in customer service. Additionally, omni-channel (website, mobile, email, call centers) customer service makes it difficult to study process ineffectiveness at an individual channel level.

In this area, process mining can help increase customer satisfaction by:

Identifying and analyzing activities with the longest throughput time (thus reducing resolution times)

Decreasing ticket handoffs by flagging how many tickets are incorrectly tagged to service categories (and identifying reasons why)

Source: Numr Research

Auditing

Auditing is changing—it's getting more data-driven, less manual, and more accurate. Standard audits use a data sample, but process mining technology enables audit teams to analyze large amounts of data in a short time. This leads to more reliable audit outcomes.

By using process mining, banks can reduce their risk of non-compliance with key industry regulations and avoid lengthy and intrusive audit procedures.

Reduce audit time and effort

Auditors have traditionally used employees for in-person interviews and manual documentation requests. With process mining technology, auditors can leverage existing transactional data to perform their audits. Which means auditors can be more data-driven and efficient.

Improve audit accuracy

Because UiPath Process Mining can analyze large quantities of data (up to one billion rows), audits are more accurate than ever.

Effective monitoring

With help from process mining tools, auditors can easily track each transaction. Process mining helps auditors by showing them what happened and when. It also helps by showing which employee, department, or business unit approved the transaction, which makes it easier to follow guidelines such as the four-eyes principle, maker-checker system, and segregation of duties control.

Evolving bank processes

Process mining objectively discovers processes. The technology analyzes processes in a very detailed way, providing specific observations and insights for improvement. Banks can use the resulting process transparency to guide automation and improvement efforts, and ensure processes help banks deliver on customer expectations.

Want to know more? Watch this webinar to hear how İşbank, Turkey’s largest private bank, leverages UiPath Process Mining capabilities to streamline their processes. Or explore the Process Mining capabilities available via the UiPath Business Automation Platform.

Sales Specialist, Emerging Products (Process Mining and Test Automation), UiPath

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.