Hyperautomation and COVID-19: Navigating Changes in the Insurance Industry

Editor's note: Special thanks to Keith Winn from Cognizant and David M. Korpalski from Hastings Mutual Insurance Company for participating in our recent webinar. We're excited to share insights from the webinar in this article.

As the world faces economic and public health uncertainty, people turn to their insurance companies to cushion themselves against losses and provide financial relief. The trouble is, many insurance companies find themselves facing the same economic hurdles and capacity strains as other businesses.

In a PwC report on the 2019 novel coronavirus (COVID-19) and the insurance industry, business leaders identified their top three concerns:

Financial impact (including effects on operational disruption, future sales slowdown, and capital / liquidity constraints)

Potential global recession

Reduction in productivity

If you’re reading this, you’re likely concerned about the same things.

Because of the numerous changes in the insurance industry due to the global pandemic, the report acknowledges that many executives feel pressure to postpone strategic investments, on transformation programs that warrant large-scale IT and infrastructure upgrades. However, it is recommended that some strategic initiatives such as digital transformation, should not be delayed because they’re key to the health of your business in both the present crisis and the long term.

Automation, when embedded as a part of those mission-critical initiatives, can not only accelerate the speed to transformation but also help to implement the programs at significantly lower cost.

“As an insurance company, we have to be quick to change—whether it’s application modernization or responding to a change in our help desk and call centers,” said David M. Korpalski, senior manager of enterprise architecture and emerging technologies at Hastings Mutual Insurance Company, during a recent webinar with UiPath, when he discussed the effects of COVID-19 on the industry. “So, we’re looking to say, ‘how can we get those expense ratios down and add that flexibility to move as the technology or society needs us to change?’”

The answer for Hastings Mutual and many other insurance companies is hyperautomation, which combines the capabilities of process automation with the integration of next-generation tools and technologies that can amplify benefits of digital transformation.

What hyperautomation means for the insurance industry

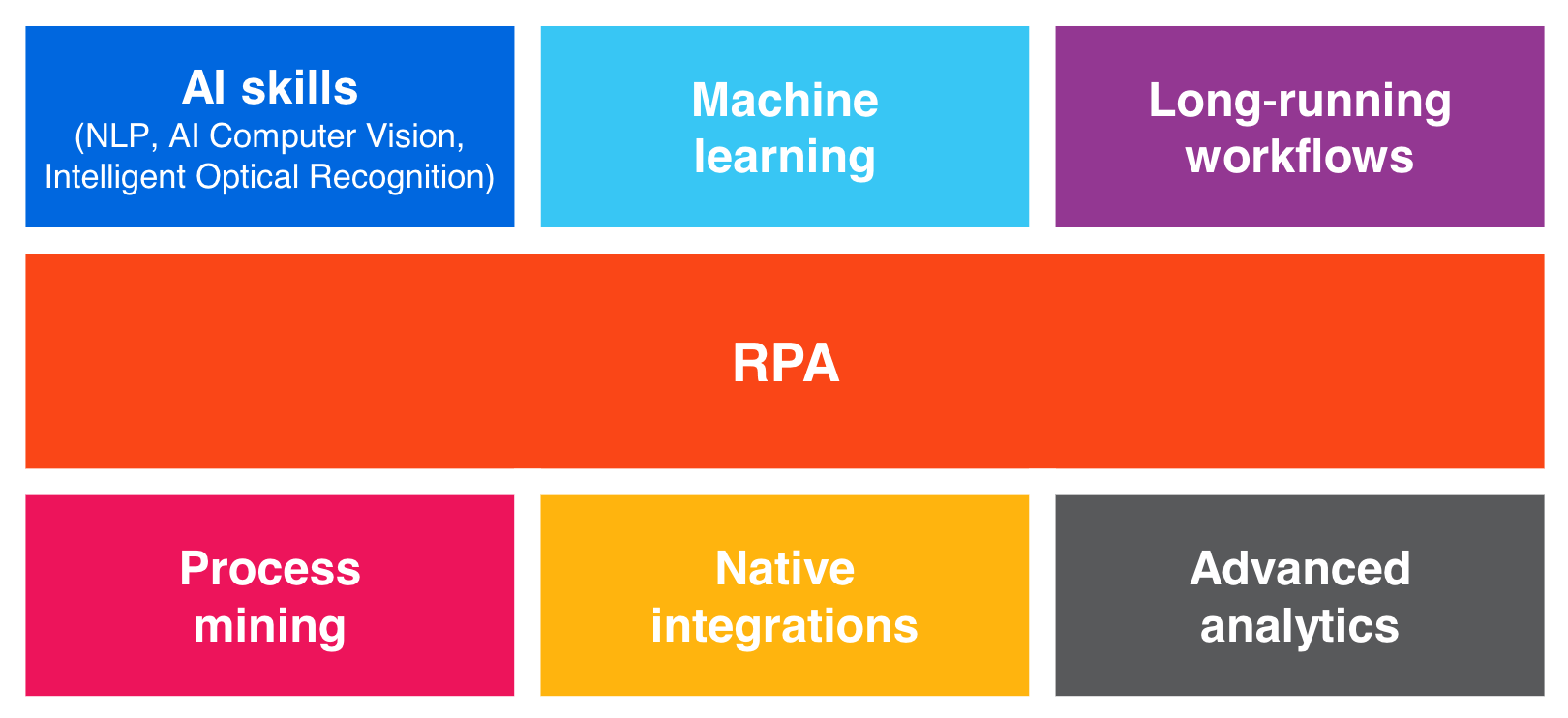

Hyperautomation was named the number one strategic technology trend in the Gartner Top 10 Strategic Technology Trends for 2020. Hyperautomation is not a single tool; it’s a combination of automation technologies, such as Robotic Process Automation (RPA), artificial intelligence (AI), process mining, and machine learning (ML).

Another way to think about hyperautomation is as a game of chess. To come out ahead in a game of chess, you need a unified strategy and clear goal(s), but you use several different pieces that function in multiple ways to achieve your desired outcome. In the same way, hyperautomation is a unified strategy with the goal of automating complex processes across an organization.

To that end, you’ll leverage various automation technologies to drive long-term transformation.

Hyperautomation strategy helps to augment your digital workforce while improving employees’ work experience thereby helping your organization to achieve operational efficiency. It’s important to understand that hyperautomation doesn’t replace RPA—it builds on RPA via the bottom-up approach of citizen-led development and top-down in identifying enterprise-wide automation opportunities.

RPA rests at the core of hyperautomation. In the chess analogy we mentioned, RPA is your queen piece—it is powerful and flexible and drives the rest of your strategy. As a high-ROI, low-code automation technology, RPA integrates seamlessly with existing systems and software, making it accessible and easy to implement.

At UiPath, we’ve built an end-to-end automation platform on a foundation of RPA to empower organizations to easily automate complex processes by uniting powerful, enterprise-wide automation technologies.

Learn more about RPA and what it can do for you in our RPA overview for the C-suite.

During this time of unprecedented demand and unanticipated challenges, companies must rethink how they do business in order to adapt to the changes in the insurance industry. It’s no longer viable to have disparate software tools, technologies, and legacy systems. This approach creates operational silos, wastes resources, and accrues technical debt—which makes it difficult to quickly pivot or scale based on shifts in the market.

UiPath partners like Cognizant are on the front lines, working through these challenges with companies who see the need to automate quickly.

“We’ve got to toss out the old strategies and reliance on single tools,” said Keith Winn, director of automation advisory practice at Cognizant, when speaking about the impact of hyperautomation on the insurance industry. An approach centered on hyperautomation creates enterprise-wide coordination to help leaders leverage value at every level of their company.

Hyperautomation makes insurance agencies more resilient to changes in the industry

The insurance industry as a whole has been slow to overhaul its core technologies, and not without good reason. Modernizing applications and upgrading legacy systems have historically been expensive and tedious. However, modernization is no longer optional. Even in 2019, the insurance industry faced new competition from tech startups, market slowdowns, an aging workforce, and customers demanding a more modern user experience. The COVID-19 pandemic has only exacerbated these issues with technical challenges, demand surge, and increased pressure from customers.

Agility is critical in adapting to the demands of the pandemic and the new normal it has brought—and an ‘automation first’ mindset is the key to achieving that agility. An automation first company operates on the principle of “if it can be automated, it should be automated” and looks for automation potential in both new and existing processes. With this approach, companies have the framework they need to fully integrate hyperautomation capabilities via an end-to-end automation platform such as UiPath.

An automation first mindset is key to agility because—like RPA—hyperautomation doesn’t require millions of dollars and years of implementation to start showing results. Less than two months after automation implementation, PZU Group saw a 15% increase in the number of claims decisions made by their agents, while call times were cut in half.

“Performance of consultants increased, and they now have more time for other tasks—they talk to clients instead of spending time generating documents. They care about customer satisfaction. Benefits are multidimensional,” project manager Tomasz Łysiak said of the results he saw at PZU Group.

Read the full story: PZU improves customer experience with RPA

In their paper covering changes in the insurance industry due to COVID-19, Deloitte identifies the ability to handle increased operational load and increased customer need for support as a key concern of executives right now. Hyperautomation empowers insurers to do well by both automating low-value repetitive tasks and by supporting employees in high-value tasks, all while keeping costs low.

Automation strengthens your customer relationships with fast, attentive service

Insurance companies around the globe have experienced a surge of claims and loss notifications. Customer service operations are overwhelmed, resulting in massive resolution delays at a time when customers need quick, attentive help. While contact center management might seem like a tactical matter, how well you handle customer issues in this time of crisis will impact your business far into the future.

Download our white paper to learn how to maximize contact center efficiency with RPA.

For one client of the consulting firm Cognizant, demand surge made building trust with customers a challenge. Due to COVID-19, they saw their claims requests surge, creating an 800-1,000 daily increase. This created delayed resolutions, which would have hurt customer satisfaction and left the company scrambling. Instead, a fast, sustainable solution was delivered.

They’re far from the only insurer to face this problem: increased demand is straining the customer service framework of many businesses, but the underlying problem existed well before the outbreak.

Disparate, disconnected agent applications limit operational efficiency. In conversations with contact center teams, UiPath has found that agents use an average of 10-15 software applications just to do their job.

Automated chatbots, powered by the conversational intelligence of AI, reduce the strain on employees by offering routing and self-service options to your customers. For issues that require your agents’ attention, intelligent agent consoles built with RPA and AI aggregate customer information from multiple systems (even legacy systems without APIs) into one holistic view.

RPA robots also automatically update information after each call, such as call notes, service tickets—even generating First Notice of Loss letters, as in the case of Cognizant’s client. UiPath worked with Cognizant to develop a solution for their client’s overwhelmed contact center. In under 40 hours, UiPath was able to deploy five robots that now handle First Notice of Loss tasks, generate letters, and automate responses.

That company’s agents can now focus their full attention on handling complex and challenging customer issues with both efficiency and empathy. Hyperautomation turns an overwhelming situation into a win for your customers, your employees, and the long-term health of your brand.

Learn more about automating your contact center in our on-demand webinar:

Leverage process understanding technology to future proof your organization

The continuing impacts of COVID-19 on the insurance industry depend largely on individual businesses and their unique portfolios, and there’s no way to predict exactly how economic factors will develop. Meeting demand surge isn’t enough—insurance companies must continually adapt and optimize to stay ahead of the crisis. To do that, they need a dynamic framework that allows them to adapt to current and future changes in the market.

While obvious low-hanging fruit gives you fast and important automation wins, it’s not always easy to identify low-hanging fruit. Automation technologies like process mining and data analytics offer you deep insight into your business and offer suggestions for high-ROI opportunities.

As you optimize your processes, you can then analyze the impact of those optimizations in real time and even model the impact of a software robot before you roll it out. This allows you to iterate quickly, stay responsive to the market, and prioritize automations based on potential ROI.

“Process mining is one of those tools in the hyperautomation stack that is completely changing the mindset at [Hastings Mutual],” Korpalski says. Hastings Mutual used process mining to dive down into the life cycle of a claim. This gave them invaluable insights into claim process bottlenecks, barriers, and opportunities to support their employees and customers alike. For Korpalski’s team, the ability to quickly examine individual transactions versus company-wide averages gave them the control they needed to truly optimize every step of their claims process.

Recommended reading: Process Mining Value: What it Means for Your Business

Process understanding technology is an essential part of your hyperautomation strategy and empowers insurers to not only survive the current changes in the insurance industry but also get ahead and stay ahead once the economy recovers.

Changes in the insurance industry demand a holistic strategy for digital transformation

Hyperautomation is not something that can occur in an IT silo. C-level support plays a critical role in building a collaborative, enterprise-wide initiative that reaps all the strategic benefits that hyperautomation has to offer. In fact, a survey by The Economist Intelligence Unit found that automation is the responsibility of a C-level executive at 84% of surveyed organizations.

“Top-down engagement shows the importance [of automation], shows how the corporation needs to survive by having lower costs and better operational efficiencies,” Korpalski says. He emphasizes the need for executives to communicate investment goals to IT and inspire cultural support for automation.

While hyperautomation may seem like a big concept with a lot of moving parts, it doesn’t have to be time consuming or costly to implement. You can get started on your journey today with our Work Ahead webinar series, which is designed to prepare you for your automation journey and support you along the way with analyst insights and expert advice. When you sign up for free, you’ll get access to all on-demand webinars, as well as preregistration for all future webinars and exclusive content.

Director, Global Insurance Practice, UiPath

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.