Robotic Process Automation – A Better Choice than FAO or BPMS

There’s no question the need for cost reduction has fueled a rapid growth in business process outsourcing (BPO) of finance and accounting functions. This specialized outsourcing: FAO (finance and accounting outsourcing), has become so prevalent the idea that major cost savings have been missed seems ludicrous. Guess what? It’s not. According to information released today by CFO.com, that’s exactly the case. FAO has barely made a dent in Finance Dept. costs. Perhaps it’s time for robotic process automation (RPA) to show outsourcing how it’s done.

Has FAO Moved the Finance Dept. Cost Needle?

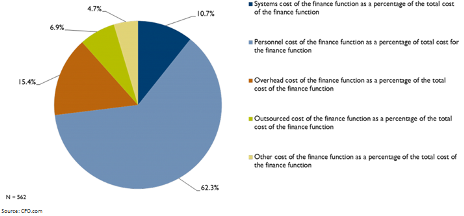

Has outsourcing led to lower finance department operating costs? Of course, no one could dispute those costs have been declining and global delivery models have been a major factor. But when 62 cents of the Finance Dept. budget dollar continues to be spent on people, no one can dispute financial and accounting outsourcing has failed to be a change agent either.

CFO.com constructed this graph with data from a survey done by APQC. The 562 surveyed organizations are predominately in the $US1B revenue range. Since every $US1B corporation is in the pursuit crosshairs of global BPO vendors, it’s safe to say the shockingly small 6.9% outsourcing cost in the Finance Dept.’s budget takes into account aggressive attempts to use outsourcing services to cut costs.

Could the argument be made the 6.9% footprint is responsible for a large overall decline in costs? Perhaps, but it is hard to see that hypothesis playing out in other operational areas. For example, after a company executes a document management outsourcing contract, does anyone expect to see personnel costs amounting to 62% of the remaining budget? Not likely.

RPA – The Best Answer for Finance Process Automation

The 6.9% outsourcing footprint in the Finance Dept.’s budget doesn’t mean financial process outsourcing is a bad answer for cost cutting, it simply means it’s the wrong answer. It’s the wrong answer because operational workflows requiring a 62.3% employee footprint aren’t ones FAO is capable of handling well – or BPMS (business process management systems).

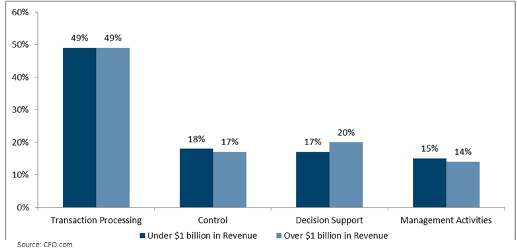

The immediate, intuitive, thought as to why Finance Dept. workflows are wrong for outsourcing or BPMS typically j

umps to high knowledge activities – highly specialized management reports, nuanced accounting adjustments for monthly, quarterly and EOY financial closings etc. In fact, that thought is correct - those would be the wrong workflows for outsourcing or complex workflow automation. Even if those workflows were applicable, it wouldn't be a game-changer. As the breakdown in Financial Dept. costs illustrate, these types of activities are such a small part of the budget that higher efficiencies would be immaterial.

The major part of the 62.3% human resource cost is transactional – the type of work customarily in the FAO or BPMS sweet spot. However, as the article points out, “on the other side of those commercial transactions sit suppliers, customers, and even employees. Until software robots can handle the sensitivity of interpersonal communications with grace and aplomb, we still need people.”

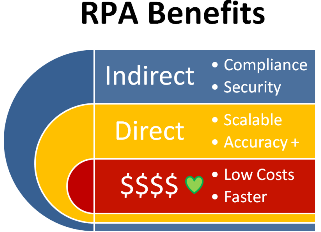

The notion put forth by the author - the Finance Dept. must decide between automation benefits and effective interpersonal relations – is a false choice. The value of robotic process automation is that it can be configured for exceptions – deferring to human intervention when specified process outcomes occur. This flexibility enables the Finance Dept. to tightly fence and define when and how its people should interact with suppliers, customers and employees, leaving all other activity outcomes to reap the cost, performance and indirect benefits of business process automation.

BPMS could provide this flexibility, but the associated implementation budget and required ROI generally restricts this technology to large end-to-end workflow automation opportunities. A highly flexible piecemeal approach to process automation only makes sense when the modest costs and loose integration of robotic software is involved.

Financial process outsourcing couldn’t provide either this flexibility or cost benefits. The need for human intervention to resolve exceptions would directly collide with the time zone constraints of global delivery. The piecemeal approach wouldn’t satisfy the scale needed to offset the fixed costs of a global delivery model.

So why hasn’t the financial world rushed to embrace robotic automation and reap the rewards? The answer likely lies in the fact Finance Dept. activities have extensive compliance and security requirements. This circumstance creates a necessarily low-risk decision-making environment when it comes to innovative process automation. Additionally, there has been little precedent set for automation in the Finance Dept. Workflows have never been of sufficient scale to warrant a BPMS approach, and the labor-centric focus of global delivery models is the antithesis of automation.

However, cost pressures on the CFO have been – and will continue to be – relentless. A move to robotic software is a question of “when”, not “if”.

Strategic Advisor, Tquila Automation

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.